At last, someone from the world of politics is being honest about a pervasive and harmful trade-off. When home prices rise faster than earnings, owners like me gain wealth, while non-owners lose because their incomes fall further behind housing costs.

Honesty is saying that home prices have to fall. But this is progress.

The Generation Squeeze folks have recommendations.

Can’t wait for whatever policy to be implemented so poorly it ends up raising house prices.

At this point, I’m certain the intention is still to prop up housing but make voters think he finally gives a shit about them so he gets re-elected. Based on his track record, I don’t have any reason to believe him.

But Pierre Poliviere’s platform of “own the libs” including banning abortion and being against trans rights is not an option.

We need ranked choice voting.

You seem to have simply forgotten about the NDP.

I think that is OP’s implication with ranked choice voting. With FPTP voting federal NDP can be the equivalent of tossing away your vote, where as with ranked ballot they would stand a chance.

Yes, ranked choice voting allows people to vote for who they want elected without being forced to vote “strategically” in what amounts to a horrible two-party system like the USA.

The problem is that idea of “strategic” voting only exacerbates the problems with fptp. If everyone voted for who they wanted, NDP would be getting a lot more votes.

Strategic voting is a self fulfilling prophecy.

“Getting more votes” doesn’t help in FPTP unless you actually get a plurality of the votes.

If everyone voted honestly, the biggest effect of the NDP would be to help the conservatives win more elections.

“Getting more votes” doesn’t help in FPTP unless you actually get a plurality of the votes.

I disagree. When everyone votes for who they actually want, everyone, including the political strategists in charge of trying to figure out how their party can win, can see what the voters really want. Yes, they will still play nasty games, but at least it will be with an awareness that there are actually a lot of people who prefer different policies.

If everyone voted honestly, the biggest effect of the NDP would be to help the conservatives win more elections.

Possibly, at least initially. But maybe the conservative strategists would see that they are courting a smaller fringe than if they had courted the socially progressive. Maybe I’m wrong, but I’ve long thought that most policies and platforms in all parties were designed to lead to victory rather than to adhere to some principled ideology.

That’s actually the inverse of what ranked choice does.

Ranked choice fulfills “later-no-harm”; filling out a third choice can never hurt your second or first choice.

Because of that, it fails “favorite betrayal”; there are times when you get a worse outcome by voting for your honest favorite.

That’s mostly because ranked choice doesn’t consider your second or third picks until your first and second have been eliminated. So there’s a bunch of weird edgecases where a compromise candidate with enough second, third etc. votes to win in the final round gets eliminated early on before they actually get any second, third etc. place support.

Suppose there’s an election like that where the Liberal is the compromise candidate that could beat either the NDP or Conservative candidate in the final round, but because the NDP and Conservative get more first-place votes, the election goes Conservative. Depending on the particulars, NDP voters could potentially have elected the Liberal by staying home, or even by voting Conservative. Either way, they’d have been better off strategically voting for the Liberal than voting honestly for the NDP.

In general, voting honestly in ranked choice is only safe either if you’re voting for a fringe third party that could never win or if you’re voting for one of the two candidates with the most total popularity.

I try to avoid telling people who to vote for but they are a viable alternative.

We need open-list MMP or some other form of non-party-list PR. Ranked choice helps, but it still means that non-hyperlocal constituency groups can be ignored. Since old people vote in droves and there are old people everywhere, local winner-take-all systems like FPTP and yes, ranked-choice, still let the politicians ignore the youth.

Regional-proportional systems like STV or MMP let a constituency in the region that has enough people for a rep regionwide but not enough for any single riding get a voice in the assembly.

I mean, on the downside, this includes Nazis. But on the upside, this includes renters.

Right???

I don’t know about ranked choice voting, frankly I believe the foxes are in the hen house and there isn’t much we can do…

But like… who do I vote for? The conservatives that still want to hate on basic sexual health and destroy healthcare? The liberals that want to do a few nice things but stop short of meaningful change?

Like…. ???

Here’s hoping that the ndp pull out a huge and useful platform, because that would be great, but after a few years in charge, they’ll do the same and still screw the populace.

I can’t trust any of them.

Yeah in 2015…aged like milk.

Ranked choice is the worst possible voting reform. We should not want that for our federal government. It strongly favours the party that would be most people’s second choice. It would guarantee the Liberals the government for the rest of time.

I haven’t been following this closely but the last thing I heard about was a big hand out to property developers, as if they need any more wealth and power and influence in our system lol

The handout is dependent on the city updating their zoning laws to make building higher density easier.

Not just easier, if we can zone an area that only has single family homes, then we can zone an area that can have minimum density requirements for each building. No paying a fine to ignore zoning or putting density in the corner of the lot only to meet requirements. We dont need these developments to be easier to build, we need to build them no matter what.

Isn’t that the point? The market crashed in 2022. Any action now is only coming to try and reverse course.

That, or to ride on the crash’s coattails, I suppose. “Look what I did!” – even though nothing was done.

I love those recommendations. An earlier post here made it seem like they only wanted to build more, which (by itself) is insufficient to keep housing affordable.

But that infographic shows a balanced set of recommendations that - taken together - will definitely help!

will definitely help!

What help do we need now, though? The market crashed last year. We needed this like 10 years ago, not after high prices finally cured high prices.

Let’s face it, the only reason we’re only now just finally getting some kind of progress on the issue is because the politicians recognize the market has crashed and want to quickly jump in to say it was their doing. It’s so weird.

The market crashed?

40-year-old two-bedroom condos are now $700k here. What crash?

Don’t bother debating with this likely troll. The article he cites literally references the rising interest rate as a significant cause for a slight dip in sales, with a reduced month-over-month percentage but still an increase over August 2022 sales. The article also cites continued attention by the government being predicted to cause sales to further cool.

The market crashed?

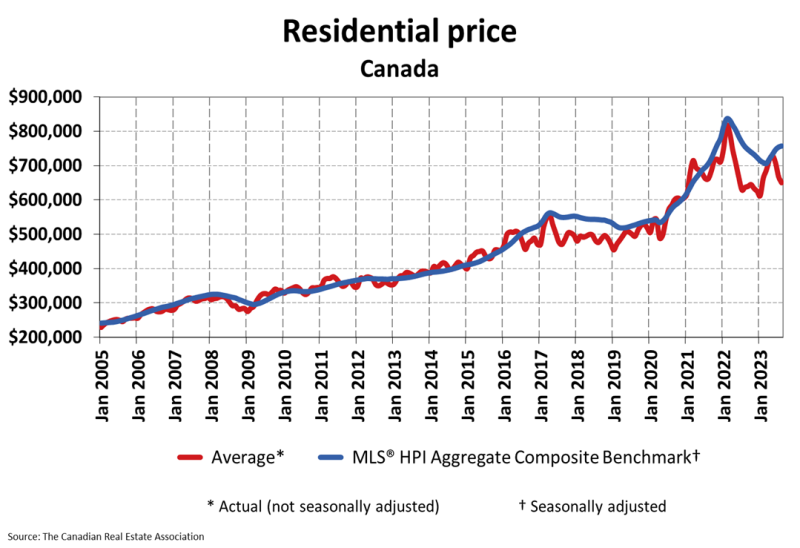

Indeed. https://creastats.crea.ca/

40-year-old two-bedroom condos are now $700k here.

- A market crash on the country scale doesn’t necessarily mean every little nook and cranny in the country has crashed. It is possible that your local market has not (yet) crashed. Calgary, for example, has not presented as having crashed yet, but it also never really got that heated.

- You have not indicated if this is list price or sale price. You asking a billion dollars for your crack shack that nobody would ever agree to doesn’t mean the market has gone up. Only the latter is significant.

- A crash is just the beginning. It took around three years for the 2006 US housing crash to find the bottom. It is not like suddenly overnight a million dollar home becomes a $300,000 home. The crash may see a million dollar home become a $300,000 home, but it will almost certainly take years to see that play out.

Did you even read your own link? Besides sales dropping 4% (which it says was expected due to the rate hikes) every other stat they listed was up year-over-year or month-over-month.

Price growth has remained solid in Quebec and the East Coast, followed by British Columbia and the Prairies. Ontario is now a mixed bag, still with some of the bigger increases but also some of the bigger declines.

That sounds to me like the only area where prices aren’t still growing are parts of Ontario and maybe the territories.

I did. Did you? Again, it’s not like one day you have a million dollar home and the next day you have a $300,000 home. That is not how it works. There is all kinds of ups and downs that follow a crash. Compare what you are seeing now to the US housing market in 2006-2007. You are going to see a lot of similarities.

I think you could argue that the market is slowing or declining, I disagree now but I could be swayed.

Saying the market is crashing though is like saying you crashed your car when you hit a pothole. Sure, if you look at a big car crash in the past someone may have blown a tire in a pothole before causing a pileup, but millions of people hit potholes every day and most are nothing more than a momentary slowdown.

I’m not saying a housing crash couldn’t be coming, but it’s unreasonable to infer that one is happening based on the data you showed.

The market crashed last year

The market: Still significantly above the pre-2020 trend.

Because we’re still riding the tail end of the dead cat bounce. That’s what a crash looks like. It is amazing how textbook perfect it is playing out to be.

Until we see a significant drop in prices, the market hasn’t crashed. Maybe it’s the dead cat bounce, or maybe prices are stable.

-

the market drop was tied to interest rates so the effective monthly mortgage is unchanged. Unless you’ve got a million bucks under your mattress to pay up-front, houses are still unaffordable.

-

renters are people too, and their prices have gone up, not down.

It’s better to say “housing costs” rather than talking about the price itself. The costs wording includes things like mortgage interest, insurance, etc.

-

Regardless of whether these are built as rentals or for sale, the catch-up to fulfill demand will take decades, and no property developer will do them if they aren’t profitable.

So don’t expect property values to seriously decline. Frankly, what we all need are wages to catch up to the cost of living.

If wages increase but housing demand remains significantly higher than supply, housing prices will just inflate. We need to build a lot more homes.

We definitely do, but people seem to think that’s a speedy election-cycle process.

I mean the solution is pretty clear. Establish residency requirements, and significantly increase taxes on places that aren’t used as primary residences.

I’ve been telling this to anyone who will listen…

At the federal level, any income, personal or corporate, from property rentals or short term rental of any single family residental property is taxed at the highest marginal rate, PLUS a surcharge of 1%, increasing at 2x the rate of inflation every year. All taxes raised from the surcharge go to federal housing programs.

At the provincial level, any property that isn’t your primary residence gets taxed at 1% of the total property value. The tax rate increases at 2x the rate of inflation every year. All taxes raised go to provincial housing programs, including rebates for first time home buyers.

At the municipal level, cities should be able to tax any property used as a short term rental at whatever rate they feel is fair. Also, any vacant property is taxed at least double the provincial rate.

This immediately stops individuals and companies from investing in single family residential properties, forces individuals and companies to divest their residential property portfolio as they become unprofitable as the tax rates increase, and slowly creates a steady flow of residential homes onto the market. It shouldn’t create a housing crash, it should stop and slowly reverse the upward trend of housing over the course of 5 to 10 years.

Please steal this idea.

I’m not sure if you mean “residency” as in residents of Canada, or residency as in living in the property.

Assuming it’s the former: Removing some investors from the pool of buyers would probably help a bit, but I’m not sure it would have a significant impact outside of a few markets.

Assuming it’s the latter: NB taxes non-primary residences at a higher rate and has still seen significant price growth.

“Yes.”

The vast majority of the money being made is being made by single home owners who live in the property. Until you start dealing with that, nothing will change.

You deal with that by flattening the upward trend (or even reversing it a little) by adding more inventory. Corporate ownership of residential housing is a big thing, as is owning second and third homes as investment properties. My upstairs neighbour with a middle-management job and a stay at home wife owns the largest suite in my building, plus two rental condos. It’s way, way more common than you think.

Corporate/multi-unit ownership isn’t higher today than it was 20 years ago, it’s actually 5-6% lower than it was 50 years ago. https://www12.statcan.gc.ca/nhs-enm/2011/as-sa/99-014-x/2011002/c-g/c-g01-eng.cfm

People love easy scapegoats they can point at instead of themselves, it’s so nice to point out the evil corporations and multi-home owners and don’t get me wrong they aren’t helping, but they are not the driving force behind our problems.

Go check AirBnB for your nearest large city. Every one of those could be a home for someone.

What does that have to do with anything I said? Airbnb is a small fraction of all units and counted in my ownership as not owner occupied. We build more new units per year than airbnb units exist in total.

Rarely, if ever, has a senior politician in Canada been courageous enough to affirm that home prices need to stall if we truly care about affordability.

Wow. Such courage. To acknowledge a problem after 8 years of ambivalence. /s

Considering his biggest donors are all speculative investors in the housing market, it is actually pretty unwise, politically, to admit that he wants to slow their profiteering.

I hate that our government is so inherently corrupt like this.

I think that’s where the courage part comes in. They’ve been pretty good about beating the drum for climate change, which alienates some voters/donors, but they’ve only really talked about housing supply, which is a great way to keep the base happy.

First step is realizing you have a problem. Small steps but yeah, it’s progress.

Is it going to be more rental properties? It’s going to be more rental properties, isn’t it.

That’s not a bad thing. More units is more units. People need shelter. Not everyone wants to buy a house to get it. If we can build enough rental units to get the supply up, it will reduce the price of “substitute goods” like other types of housing. Plus, density is far more sustainable to build.

The bill removes GST from purpose built rental, so yes.

Uh, what rising home prices?

You mean the dead cat bounce seen earlier this year? That’s just confirmation of the market having already crashed.

I find it funny how hard you try yet fail miserably. What a douche canoe.

Interesting that you think pointing out the obvious requires effort. It does not. It requires almost no effort at all. The data speaks for itself.

I suppose when one is more concerned about people than information, life no doubt seems hard. Data is simple, but people can be quite complex. I am not sure there is actually any value in that complexity, though. Have you considered that you might be challenging yourself for no reason?

What’s funny is how much you assume from what little you know.

What’s funny is that you don’t realize that’s what conversation is for – to learn about what you don’t know.

If one knew absolutely everything they would have absolutely no reason to speak.

Keep assuming from nothing.

My passion for education ensures that I will.

You’re an idiot